UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

1st Constitution Bancorp

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction:: | |

5. | Total fee paid: | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: | |

1ST CONSTITUTION BANCORP

P.O. Box 634

2650 Route 130 North

Cranbury, New Jersey 08512

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD THURSDAY, MAY 22, 201425, 2017

To Our Shareholders:

The 20142017 Annual Meeting of Shareholders of 1st Constitution Bancorp will be held on Thursday, May 22, 201425, 2017 at 3:00 p.m. Eastern Time at the Forsgate Country Club, 375 Forsgate Drive, Monroe Township, New Jersey.

Jersey, 08831.

At the Annual Meeting, shareholders will be asked to consider and vote upon the following matters:

| 1. | The election of |

| 2. | The approval of the compensation of our named executive officers on an advisory (non-binding) basis; |

| 3. | The ratification of the selection of BDO USA LLP as the Company’s independent registered public accounting firm for the |

| 4. | The conduct of other business if properly raised. |

Shareholders of record at the close of business on April 1, 20145, 2017 are entitled to notice of, and to vote at, the Annual Meeting. Whether or not you contemplate attending the Annual Meeting, we suggest that you promptly execute the enclosed proxy and return it to the Company.Company or submit your proxy on the Internet as instructed on the enclosed proxy card. You may revoke your proxy at any time prior to the exercise of the proxy by delivering to the Company a later-dated proxy or by delivering a written notice of revocation to the Company.

The Board of Directors of the Company believes that the election of the nominees and the proposals being submitted to the shareholders are in the best interest of the Company and its shareholders and urges you to vote in favor of the nominees and the proposals.

Important notice regarding the availability of proxy materials for the 20142017 Annual Meeting of Shareholders: The Proxy Statement for the 20142017 Annual Meeting of Shareholders and 20132016 Annual Report to Shareholders are available at: http://www.cfpproxy.com/4584.www.astproxyportal.com/ast/20330/.

By Order of the Board of Directors ROBERT F. MANGANO President and Chief Executive Officer |

Cranbury, New Jersey

April 15, 201424, 2017

YOUR VOTE IS IMPORTANT

To assure your representation at the Annual Meeting, please vote your proxy as promptly as possible, whether or not you plan to attend the Annual Meeting. The prompt return of proxies will save the Company the expense of further requests for proxies to ensure a quorum at the Annual Meeting. A stamped self-addressed envelope is enclosed for your convenience.

1ST CONSTITUTION BANCORP

P.O. Box 634

2650 Route 130 North

Cranbury, New Jersey 08512

PROXY STATEMENT FOR ANNUAL MEETING

OF SHAREHOLDERS TO BE HELD ON MAY 22, 201425, 2017

GENERAL PROXY STATEMENT INFORMATION

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of 1st Constitution Bancorp (the “Company”), for use at the 20142017 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on May 22, 2014,25, 2017, at 3:00 p.m. Eastern Time, at the Forsgate Country Club, 375 Forsgate Drive, Monroe Township, New Jersey.

Jersey, 08831.

The first date on which this proxy statement and the enclosed form of proxy are being sent to the shareholders of the Company is on or about April 15, 2014.

24, 2017.

The Company’s principal executive office is P.O. Box 634, 2650 Route 130 North, Cranbury, New Jersey 08512. 1st Constitution Bank is a wholly-owned subsidiary of the Company and is sometimes referred to as the “Bank.”

Outstanding Securities and Voting Rights and Procedures

The Board of Directors fixed the close of business of the Company (5:00 p.m. Eastern Time) on April 1, 20145, 2017 as the record date and time for determining shareholders entitled to notice of, and to vote at, the Annual Meeting. Only shareholders of record as of that date and hour will be entitled to notice of, and to vote at, the Annual Meeting.

On the record date, there were 7,084,7258,027,342 shares of common stock of the Company outstanding and eligible to be voted at the Annual Meeting.Each share is entitled to one vote on each matter properly brought before the Annual Meeting. Other than Company common stock, there are no other outstanding securities of the Company entitled to vote at the Annual Meeting.

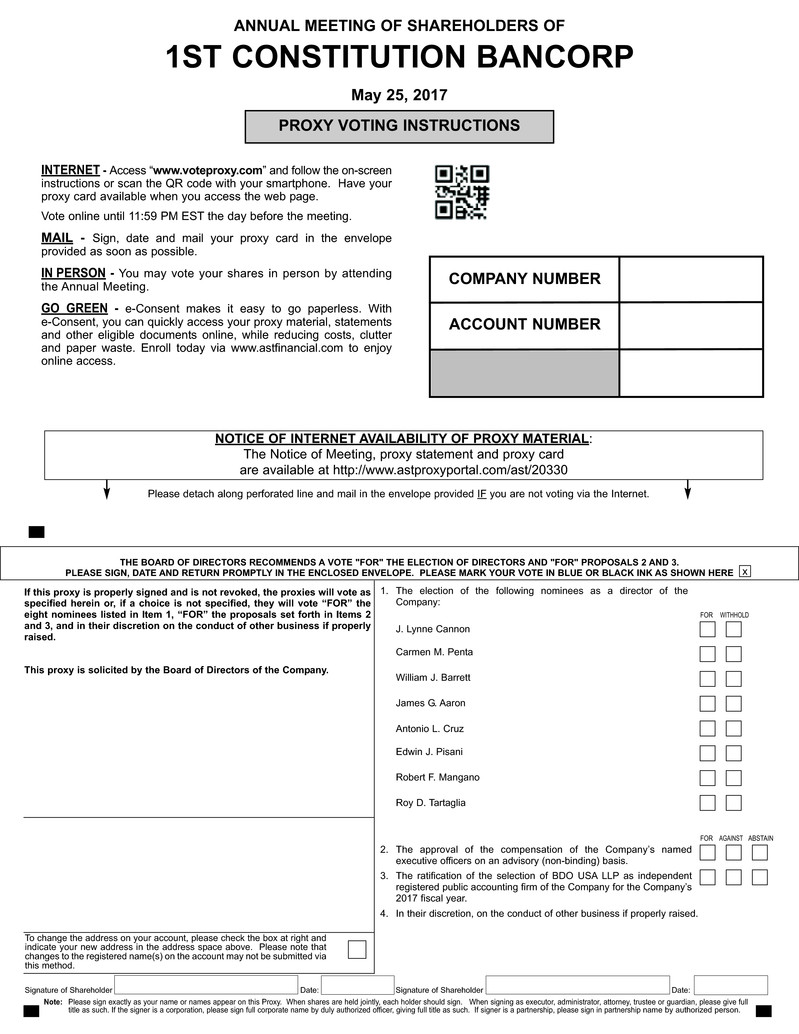

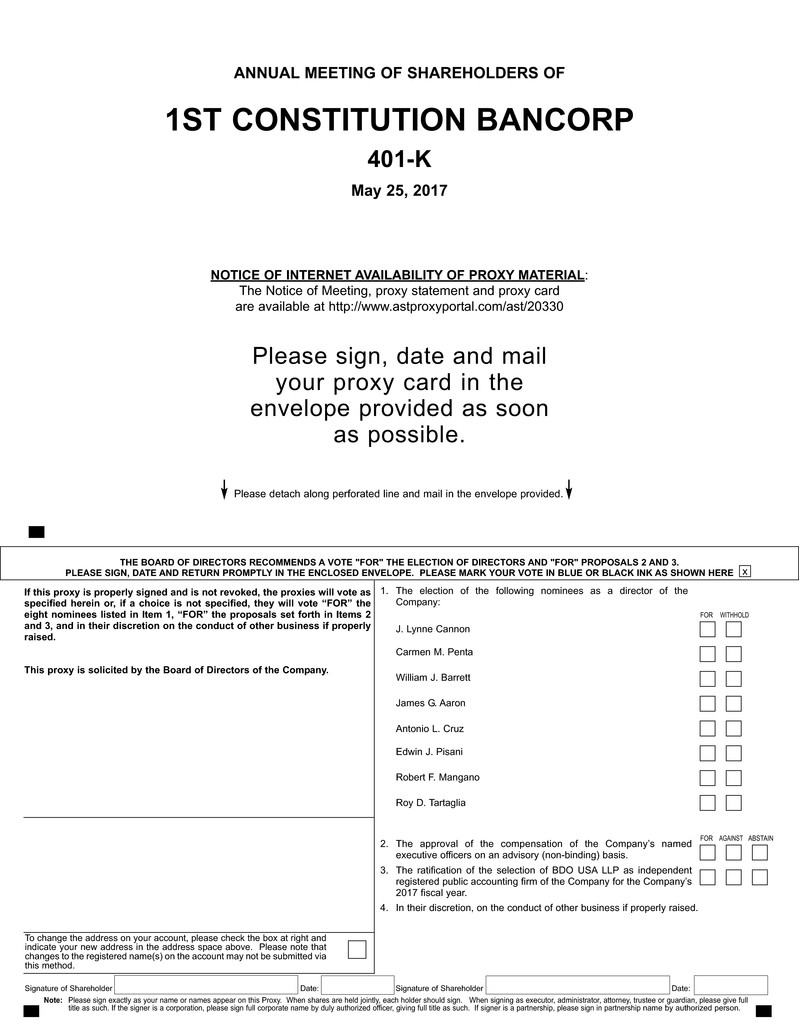

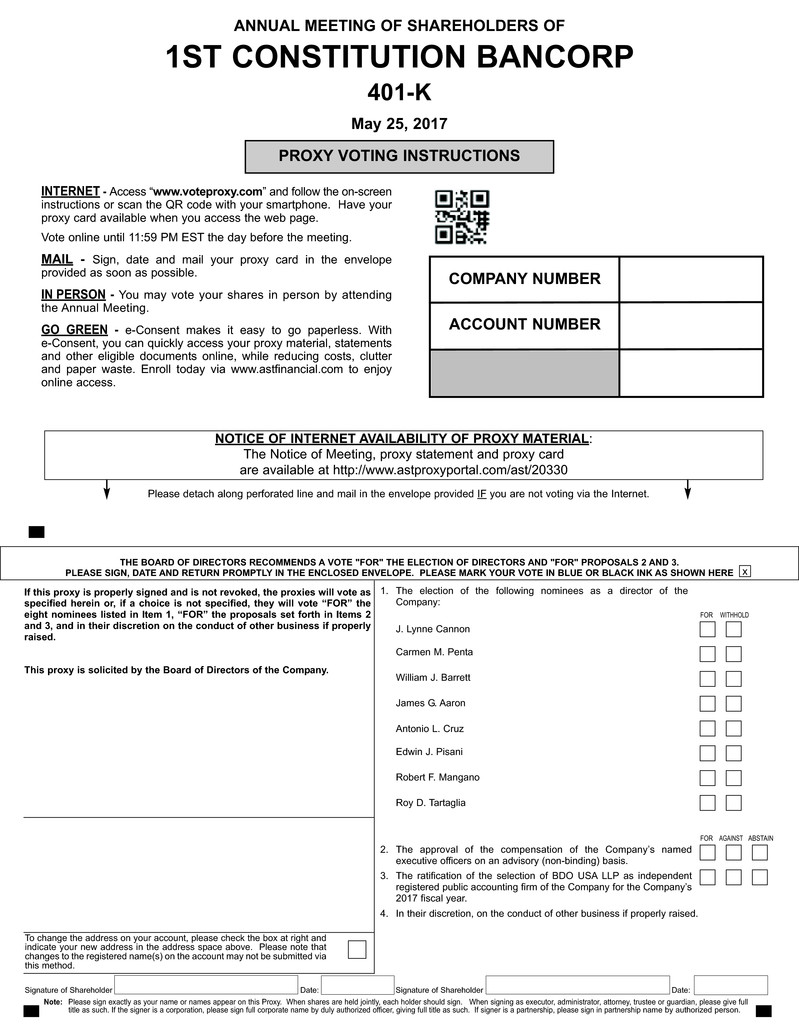

To vote your proxy by mail, please sign your name exactly as it appears on your proxy card, date, and mail your proxy card in the envelope provided as soon as possible. If you wish to vote using the Internet, you can access the web page at www.voteproxy.com and follow the on-screen instructions. Have

your proxy card available when you access the web page. If you vote using the Internet, you must vote no later than 11:59 p.m. Eastern Time on May 24, 2017.

If any other matters are properly presented at the Annual Meeting for consideration, such as consideration of a motion to adjourn the Annual Meeting to another time or place, the persons named as proxies will have discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote, unless the shareholder otherwise specifies in the proxy. AtAs of the date of this proxy statement, we do not anticipate that any other matters will be raised at the Annual Meeting.

Required Vote

The presence, in person or by proxy, of the holders of a majority of the shares entitled to vote generally is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that item and has not received voting instructions from the beneficial owner.

Certain proposals, such as the ratification of the appointment of auditors, are considered “routine” matters and brokers generally may vote on behalf of beneficial owners who have not furnished voting instructions. For “non-routine” proposals, such as the election of directors and the advisory vote to approve the compensation of our named executive officers, brokers may not vote on the proposals unless they have received voting instructions from the beneficial owner.

The affirmative vote of a plurality of the votes cast at the Annual Meeting is required to elect a director. An abstention or a broker non-vote will have no effect on the outcome of the vote on the election of a director. The affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve the compensation of our named executive officers and ratify the selection of BDO USA LLP as the Company’s independent registered public accounting firm for the 20142017 fiscal year. The vote for the approval of the compensation of our named executive officers is on an advisory basis and is therefore non-binding. For these last two proposals, abstentions and broker non-votes will not be counted as votes and, accordingly, will have no effect on the outcome of the vote.

Election inspectors appointed for the Annual Meeting will tabulate the votes cast by proxy or in person at the meeting. The election inspectors will determine whether or not a quorum is present. Votes will NOT be considered cast if the shares are not voted for any reason, including an abstention indicated as such on a written proxy or ballot, if directions are given in a written proxy to withhold votes, or if the votes are withheld by a broker.

Revocability of Proxies

Any shareholder giving a proxy has the right to attend and vote at the Annual Meeting in person. If your shares are held in the name of a bank, broker, or other holder of record, you must obtain a proxy executed in your favor from the holder of record to be able to vote at the Annual Meeting. If you submit a proxy and then wish to change your vote, you will need to revoke the proxy that you have submitted. You can revoke your proxy at any time before it is exercised by voting in person at the Annual Meeting or by timely delivery of a properly executed, later-dated proxy or a written revocation of your proxy. A later-dated proxy or written revocation must be received before the meeting by the Corporate Secretary of the

Company, at P.O. Box 634, 2650 Route 130 North, Cranbury, New Jersey 08512, or it must be delivered to the Corporate Secretary at the Annual Meeting before proxies are voted.

You may also revoke your proxy by submitting a new proxy via the Internet no later than 11:59 p.m. Eastern Time on May 24, 2017.

Multiple Copies of Annual Report and Proxy Statement

When more than one holder of Company common stock shares the same address, we may deliver only one annual report and one proxy statement to that address unless we have received contrary instructions from one or more of those shareholders. Similarly, brokers and other intermediaries holding shares of Company common stock in “street name” for more than one beneficial owner with the same address may deliver only one annual report and one proxy statement to that address if they have received consent from the beneficial owners of the stock.

We will deliver promptly, upon written or oral request, a separate copy of the annual report and proxy statement to any shareholder, including a beneficial owner of stock held in “street name,” at a shared address to which a single copy of either of those documents was delivered. You may make such a request in writing to Stephen J. Gilhooly, Senior Vice President and Chief Financial Officer, 1st Constitution Bancorp, at P.O. Box 634, 2650 Route 130 North, Cranbury, New Jersey 08512, or by calling Mr. Gilhooly at (609) 655-4500. This proxy statement and the annual report are available at: http://www.cfpproxy.com/4584.

www.astproxyportal.com/ast/20330/.

You may also contact Mr. Gilhooly at the address or telephone number above if you are a shareholder of record of the Company and you wish to receive a separate annual report or proxy statement, as applicable, in the future, or if you are currently receiving multiple copies of our annual report and proxy statement and want to request delivery of a single copy in the future. If your shares are held in “street name” and you want to increase or decrease the number of copies of our annual report and proxy statement delivered to your household in the future, you should contact the broker or other intermediary who holds the shares on your behalf.

Solicitation of Proxies

This proxy solicitation is being made by the Board. The cost of the solicitation will be borne by the Company. In addition to the use of the mails, proxies may be solicited personally or by telephone, facsimile, email, or other electronic means by officers, directors and employees of the Company. We will not specially compensate those persons for such solicitation activities. Although we do not expect to do so, we may retain a proxy-soliciting firm to assist us in soliciting proxies. If so, we would pay the proxy-soliciting firm a fee and reimburse it for certain out-of-pocket expenses. Arrangements may be made with brokerage houses and other custodians, nominees and fiduciaries for forwarding solicitation materials to the beneficial owners of common stock held of record by such persons, and we will reimburse such persons for their reasonable expenses incurred in forwarding the materials.

Smaller Reporting Company

Status

The Company has elected to prepare this proxy statement and otherour past annual and periodic reports as a “smaller reporting company” consistent with rules of the Securities and Exchange Commission.Commission (“SEC”). The Company met the accelerated filer requirements as of the end of its fiscal year ended December 31, 2016 pursuant to Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). However, pursuant to Rule 12b-2 and SEC Release No. 33-8876, the Company (as a smaller reporting company transitioning to the larger reporting company system) is not required to

satisfy the larger reporting company disclosure requirements until its first Quarterly Report on Form 10-Q for the fiscal year ending December 31, 2017.

ITEM 1 -– ELECTION OF DIRECTORS

The Company’s Board of Directors is divided into three separate classes of directors, designated as Class I, Class II and Class III. The directors inCharles S. Crow, who is a Class I aredirector, is serving a three-year term which expires in 2015; the directors in2018 and William M. Rue, who is a Class II aredirector, is serving a three-year term which expires in 2016; and the directors in Class III are serving a three-year term which expires in 2014, and2019, in each case until their successors are duly elected and qualified. In 2016 and 2017, the Board authorized, on several occasions, the expansion of the size of the Board and elected three new Class I directors (J. Lynne Cannon, Carmen M. Penta and William J. Barrett), two new Class II directors (James G. Aaron and Antonio L. Cruz) and two new Class III directors (Edwin J. Pisani and Roy D. Tartaglia) to fill the vacancies created by such expansion of the Board. Under New Jersey corporate law, directors so elected by the Board shall hold office until the next succeeding annual meeting of shareholders and until their successors are duly elected and qualified. Accordingly, these seven new directors and Robert F. Mangano, who is a Class III director last elected to the Board by shareholders of the Company in 2014 and whose term as a director is due to expire at the 2017 Annual Meeting, are standing for election at the Annual Meeting. At each annual meeting of shareholders following the 2017 Annual Meeting, one class of directors will be elected for terms of three years to succeed those directors in the class whose terms then expire.

The Company’s certificate of incorporation requires each class of directors to consist as nearly as possible of one-third of the authorized number of directors. In the event that a nominee stands for election as a director at an annual meeting of shareholders as a result of an increase by the Board of Directors of the authorized number of directors and such nominee is to serve in a class of directors whose term is not expiring at such annual meeting of shareholders, the nominee, if elected, may stand for an initial term expiring concurrent with the expiration of the term of the directors in the class to which such nominee is elected as a director.

The director nominees for election at the 2017 Annual Meeting areare: (i) the twothree nominees for election as Class IIII directors, John P. Costas J. Lynne Cannon, Carmen M. Penta and Robert F. Mangano,William J. Barrett, who, if elected, will serve a three-year termone-year terms expiring in 20172018 and until their successors are duly elected and qualified; (ii) the two nominees for election as Class II directors, James G. Aaron and Antonio L. Cruz, who, if elected, will serve two-year terms expiring in 2019 and until their successors are duly elected and qualified; and (iii) the three nominees for election as Class III directors, Robert F. Mangano, Edwin J. Pisani and Roy D. Tartaglia, who, if elected, will serve three-year terms expiring in 2020 and until their successors are duly elected and qualified.

The number of nominees was determined by the Board of Directors pursuant to the Company’s by-laws. If, for any reason, eitherany nominee for director is unable or unavailable to serve or for good cause will not serve, the shares represented by the accompanying proxy will be voted for a substitute nominee designated by the Board or the size of the Board may be reduced. The Board believes that the named nominees are available, and, if elected, will be able to serve.

DIRECTORS AND EXECUTIVE OFFICERS

The following tables set forth (i) the name, age and class of the nominees for election to director, the names, ages and classes of the directors whose terms extend beyond 20142017 and the name and age of the executive officer of the Company who does not also serve as a director of the Company, (ii) the other positions and offices presently held by such persons with the Company, if any, (iii) the period during

which such persons have served on the Board of Directors, if applicable, (iv) the expiration of each director’s term as a director if such nominee is elected as a director at the 2017 Annual Meeting and (v) the principal occupations and employment of such persons during the past five years. Additional biographical information for each person follows the tables.

NOMINEES FOR ELECTION AT 20142017 ANNUAL MEETING

Name and Position with the Company, if any | Age | Class | Director Since | Expiration of Term | Principal Occupation |

| John P. Costas, Director | 57 | III | 2011 | 2014 | Managing Member of Costas Holdings, LLC/Key Largo, Florida |

Robert F. Mangano, Director, President and Chief Executive Officer | 68 | III | 1999 | 2014 | President and Chief Executive Officer, 1st Constitution Bank/Cranbury, New Jersey |

Name and Position with the Company, if any | Age | Class | Director Since | If Elected, Expiration of Term | Principal Occupation |

| J. Lynne Cannon | 70 | I | 2016 | 2018 | Chief Executive Officer, Consulting, Princeton Management Development Institute, Trenton, NJ |

| Carmen M. Penta | 72 | I | 2017 | 2018 | CPA, Partner, Addeo, Polacco & Penta, LLC, Eatontown, New Jersey |

| William J. Barrett | 61 | I | 2017 | 2018 | Adjunct Professor, LeMoyne College CPA, Retired Partner, Ernst & Young, LLP |

| James G. Aaron | 72 | II | 2016 | 2019 | Attorney, Partner, Ansell Grimm & Aaron, Ocean Township, NJ |

| Antonio L. Cruz | 61 | II | 2016 | 2019 | Retired |

| Edwin J. Pisani | 67 | III | 2016 | 2020 | CPA, Retired Partner, Ernst & Young, LLP |

| Roy D. Tartaglia | 66 | III | 2016 | 2020 | Retired |

| Robert F. Mangano, President and Chief Executive Officer | 71 | III | 1999 | 2020 | President and Chief Executive Officer, 1st Constitution Bank/Cranbury, New Jersey |

Set forth below areis the namesname of, and certain biographical information regarding, the director nominees.

J. Lynne Cannon John P. Costas is the Managing Member of Costas Holdings, LLC, a private equity firm, since July 2012. Mr. Costas was Chairman of PrinceRidge LLC, a financial services firm, from 2009 to July 2012. Mr. Costas was with UBS, a financial services firm, from 1996 to 2007. During his tenure at UBS, Mr. Costas held various positions, including Deputy CEO of UBS A.G., Chairman and CEOhas been Chief Executive Officer of the UBS Investment BankPrinceton Management Development Institute, a firm serving biotechnology and Chairmanpharmaceutical businesses, since 2006. Prior to this, Ms. Cannon served as Global Sr. Vice President of Human Resources for Novartis Biomedical Research Institute and CEOfor Bristol Myers Research. Ms. Cannon has more than 30 years of Dillon Read Capital Management LLC. Mr. Costas wascorporate and consulting experience in areas such as global strategic business and human resources management, organizational development and restructuring, executive search and selection and leadership development. Ms. Cannon holds graduate degrees in Organizational and Counseling Psychology from Columbia University where she has also pursued

doctoral studies. Ms. Cannon has been a member of the UBS Group Executive Management Committee from 2001RWJ Hamilton Board of Directors for more than 16 years, where she has served as the Chair and Vice Chair.

Ms. Cannon is qualified to 2005.serve on our Board of Directors because of her education, her business skills and expertise, and her extensive consulting experience as well as service on other boards.

Carmen M. Penta, a Certified Public Accountant, has been a partner in the firm of Addeo, Polacco & Penta, LLC in Eatontown, New Jersey since 2014. From January 1998 to March 2014, Mr. Penta was a partner at EisnerAmper LLP. Prior to joining UBS,that, Mr. CostasPenta was with CS First Boston Corporation from 1981 to 1996. While at CS First Boston Corporation,a partner in the accounting firms of Wiener, Penta & Goodman, P.C., and Amper, Politziner & Mattia, P.C., Certified Public Accountants and Consultants. Mr. Costas held several positions, including Co-Global Head of the Fixed Income Division. Mr. Costas alsoPenta previously served as a director for Colonial American Bank, where he served as a member of the NYSE advisory board.Colonial American Bank compensation committee and as chairman of the audit committee. Mr. Costas has a B.A. from the University of Delaware and an MBA from the Tuck School at Dartmouth College. Mr. Costas servesPenta also served as a director of A Better Chance National Board. Additionally, Mr. Costas is a member of the board of directors of Central Jersey Bancorp from January 26, 2006 until November 30, 2010 when Central Jersey Bancorp was merged with and into Kearny Financial Corp. Prior to the Ocean Reef Club in Key Largo, Florida.consummation of the combination of Central Jersey Bancorp and Allaire Community Bank on January 1, 2005, heserved as a member of the board of directors of Monmouth Community Bancorp (the predecessor to Central Jersey Bancorp) since its inception. Mr. Penta also served as a member of the board of directors of Central Jersey Bank, N.A. since its inception. Mr. Penta serves on the board of trustees of the Brookdale Foundation. He is a former member of the Congressional Award Council, a past member of the Advisory Board of Jersey Shore Bank, past Assistant Treasurer for the Long Branch Ronald McDonald House and served on the board of directors of the West Long Branch Sports Association. He is also a member of the New Jersey Society of Certified Public Accountants, the American Institute of Certified Public Accountants and the Finance Committee of Big Brothers, Big Sisters. Mr. Penta attended Penn State University and received a B.S. degree from Monmouth University.

Mr. CostasPenta is qualified to serve on our Board of Directors because of his decadeseducation, his business skills and expertise, and his extensive accounting knowledge, acquired through the years from practicing as a certified public accountant as well as service on other boards.

William J. Barrett, a Certified Public Accountant, retired from Ernst & Young LLP in June 2016, where he was a partner since October 1989. While at Ernst & Young LLP, Mr. Barrett advised clients across a variety of industries, including local, regional and international banks and other financial services organizations. Mr. Barrett has experience in assessing and advising on business technology and technology-related risks, including cybersecurity. Since August 2016, Mr. Barrett has been an adjunct professor at LeMoyne College in Syracuse, NY and a member of its board of trustees and finance and audit committee since 2008. Mr. Barrett has a B.S. degree in Accounting from LeMoyne Collage and an M.B.A. in Finance from Case Western Reserve University.

Mr. Barrett is qualified to serve on our Board of Directors because of his education, his business skills and expertise, and extensive accounting knowledge, and his extensive experience with technology-related risk.

James G. Aaron is a senior member and shareholder in the law firm of Ansell, Grimm &Aaron, P.C., located in Ocean Township, New Jersey, and has been with such law firm since 1996. Mr. Aaron chairs the firm’s Municipal Law and Bankruptcy Practice Department. Mr. Aaron is licensed to practice law in the State of New Jersey, the United States District Court for the District of New Jersey, the United States District Court for the Eastern District of New York, and the United States Court of Claims. Mr. Aaron is also vice president and chairman of the board of directors of ERBA Co., Inc. Mr. Aaron

presently serves as the municipal attorney for the City of Long Branch and is a member of the Monmouth County and New Jersey State Bar Associations. Mr. Aaron is a founder of Central Jersey Bank, N.A., a federally chartered institution, and served from 1996 until 2010 as a director and member of its executive committee. Mr. Aaron also served as a director of Colonial American Bank, and as chairman of the board of directors of Rumson-Fair Haven Regional Bank (prior to its merger with 1st Constitution Bank in February 2014). Since February 2014, he has served as a director of 1st Constitution Bank, where he serves on the loan, investment, and nominating committees. Mr. Aaron is currently a member of the board of trustees of Monmouth Medical Center, part of the Saint Barnabas Medical System, where he serves on the strategic planning, medical practices, and community action committees. Mr. Aaron is a member of the board of trustees of the Axelrod Performing Arts Center, and has been a long-time member of the board of trustees of Hollywood Golf Club, where he is presently president, in Deal, New Jersey. Mr. Aaron received his B.A. degree from Dickinson College in Carlisle, Pennsylvania and his J.D. from New York University School of Law.

Mr. Aaron is qualified to serve on our Board of Directors because of his education, his business skills and expertise, including service on the board of 1st Constitution Bank, and his extensive legal knowledge, acquired through the years from private legal practice as well as service on other boards.

Antonio L. Cruz has been a director of 1st Constitution Bank since 2003, where he serves on the Loan and Investment Committee and the ALCO Committee. Mr. Cruz was an attorney in private practice in Perth Amboy, NJ. Previously, he served as a general counsel to the Perth Amboy Board of Education and has represented a number of financial institutions as a review attorney in both residential and commercial real estate law. Mr. Cruz was a member of the Hispanic Bar Association of New Jersey in which he served as a member of the board of trustees for many years. Mr. Cruz received his J. D. from Northeastern University School of Law in Boston, MA, and practiced civil litigation and transactional real estate for nearly 28 years.

Mr. Cruz is qualified to serve on our Board of Directors because of his education, his business skills and expertise, including service on the board of 1st Constitution Bank, and his extensive legal knowledge, acquired through the years from private legal practice as well as service on other boards.

Edwin J. Pisani has been a director of 1st Constitution Bank since 2014 and has over forty years of audit and advisory experience in the financial industry.services industry, most recently as the managing partner of Ernst & Young LLP’s Risk Management and Regulatory Consulting practice, from which he retired in June 2014. Mr. Costas bringsPisani also serves on the boards of directors and audit committees of Peak Offshore Funds, Ballymena Funds and CSCC Trade. Mr. Pisani has a B.S. in electrical engineering from Clarkson University, a Masters of Business Administration from Carnegie Mellon University, and a Masters of Accounting from Northwestern University.

Mr. Pisani is qualified to serve on our Board of Directors because of his education, his business skills and expertise, and his extensive financial experienceand accounting knowledge.

Roy D. Tartaglia was a co-founder and has been a director of 1st Constitution Bank since 1989. Prior to his retirement in 2000, Mr. Tartaglia was the Board as a former chief executive officer with two different financial services companiesof RTK Group, a telecommunications company, where he oversaw mergers and acquisition activity, operations, finance and marketing functions. Mr. Tartaglia was educated at Brandywine College, and was named to Who’s Who in America Junior Colleges.

Mr. Tartaglia is qualified to serve on our Board of Directors because of his education, his business skills and expertise, including service on the board of 1st Constitution Bank, and his prior affiliation with UBS where he had broad banking and creditextensive management responsibilities.knowledge, gained through years of serving as a chief executive officer.

Robert F. Mangano is the President and Chief Executive Officer of the Company and of the Bank. Prior to joining the Bank in 1996, Mr. Mangano was President and Chief Executive Officer of Urban National Bank, a community bank in the northern part of New Jersey, for a period of three years and a Senior Vice President of another bank for one year. Prior to such time, Mr. Mangano held a senior position with Midlantic Corporation for 21 years. Mr. Mangano is Treasurerchairman of the audit committee of the Englewood Hospital Medical Center and serves as Trusteea trustee of the Boardboard of Englewood Hospital Medical Center, as well as being Chairman of the Finance Committee and the Compensation Committee.Center.

Mr. Mangano is qualified to serve on our Board of Directors because of his business skills and experience, his extensive knowledge of financial and operational matters acquired from a long and illustrious career working for several banks in increasingly senior roles and leadership positions, and his deep understanding of the Company’s and the Bank’s people and products that he has acquired in over 1820 years of service.

DIRECTORS WHOSE TERMS EXTEND BEYOND THE 20142017 ANNUAL MEETING

Name and Position with the Company, if any | Age | Class | Director Since | Expiration of Term | Principal Occupation |

Charles S. Crow, III, Chairman of the Board | 64 | I | 1999 | 2015 | Attorney, Crow & Cushing/ Princeton, New Jersey |

| David C. Reed, Director | 63 | I | 2004 | 2015 | CEO, Mapleton Nurseries/ Kingston, New Jersey and Managing Director, Reed & Company/Princeton, New Jersey |

William M. Rue, Director and Corporate Secretary | 66 | II | 1999 | 2016 | Chairman, Charles E. Rue & Son, Inc./Trenton, New Jersey |

| Frank E. Walsh, III, Director | 47 | II | 1999 | 2016 | Vice President, Jupiter Capital Management Partners, LLC/Morristown, New Jersey |

Name and Position with the Company, if any | Age | Class | Director Since | Expiration of Term | Principal Occupation |

| Charles S. Crow, III, Chairman of the Board | 67 | I | 1999 | 2018 | Attorney, Crow & Cushing/ Princeton, New Jersey |

| William M. Rue, Director and Corporate Secretary | 69 | II | 2011 | 2019 | Chairman, Chas E. Rue & Son, Inc./Hamilton, New Jersey |

Set forth below are the names of, and certain biographical information regarding, the directors of the Company whose terms extend beyond the 20142017 Annual Meeting.

Charles S. Crow, III has served as the Chairman of the Board of the Company and of the Bank since March 2005. From February 2000 until May 2005, Mr. Crow served as corporate secretary of the Company. Mr. Crow is a partner in the law firm of Crow & Cushing in Princeton, New Jersey, which is the successor to Crow & Associates following the addition of an existing partner’s name to the name of the law firm in 2013.Associates. From January 1, 1992 to November 30, 1998, Mr. Crow was a partner in the law firm of Crow & Tartanella in Somerset, New Jersey. Mr. Crow serves as a director of each of Arden-Sage Multi-Strategy TEIQCM OTUS Fund (formerly Robeco-Sage TriconSPC LTD AFP SP; QCM OTUS Fund SPC GDP SP; Blenheim Commodity Fund, Ltd; Blenheim Global Markets Fund, Ltd.); Blenheim Diversified Dynamic Alpha Fund, Ltd.; Parsoon Opportunity Fund Ltd.; Tenor Opportunity Master Fund Ltd.; Tenor Opportunity Fund Ltd.; Aria Opportunity Fund, Ltd.; and Arden-Sage Multi-StrategyAria Opportunity Offshore Fund, (formerly Robeco-Sage Multi-Strategy Fund), each of which isLtd. In the past, Mr. Crow has served as a closed-end, non-diversified, managementtrustee with respect to alternative mutual funds and other registered investment company that isadvisory companies registered with the SEC under the Investment Company Act of 1940, as amended. Mr. Crow is also a director of Otus Fund Ltd., Otus Fund SPC Ltd., Blenheim Commodity Fund, Ltd., Blenheim Global Markets Fund, Ltd., Blenheim Diversified Dynamic Alpha Fund, Ltd., Arden Investment Series Trust (ARDNX), Aria Opportunity Fund, Ltd., Aria Opportunity Offshore Fund, Ltd., Parsoon Opportunity Fund Ltd., Tenor Opportunity Master Fund, Ltd. and Tenor Opportunity Fund, Ltd., each of which is an1940. The companies mentioned are open-ended fund companycompanies invested in traditional and alternative investments. In addition, Mr. Crow sits on the Board of Managers of Investor Analytics LLC., which provides risk analytics to portfolio managers, investors and others through the use of advanced mathematical tools and methodologies. Mr. Crow is also a director and member of the compensation and finance committeescommittee member of Centurion Ministries, Inc., a nonprofit entity that seeks to vindicate and free from prison those individuals in North America who are factually innocent of the crimes for which they have been unjustly convicted and imprisoned, for life or death.and is also a trustee of the Antique Boat Museum in Clayton, New York, serving on the audit and finance committees.

Mr. Crow is qualified to serve on our Board of Directors because of his education, his business skills and expertise, and his extensive legal knowledge, acquired through the years from private legal practice as well as service on other boards.

William M. Rue has served as Chairman of CharlesChas. E. Rue & Son, Inc., an insurance agency which has its principal office in Trenton,Hamilton, New Jersey, since February 2013, and served previously as its President from 1985 to February 2013. Mr. Rue is a director of The Rue Foundation, a nonprofit corporation, and is a general partner at Rue Brothers, Ltd. Mr. Rue also served as Chairman of Rue Financial Services, Inc., a financial services provider, from 2002 to 2012. Mr. Rue has been a Chartered Property Casualty Underwriter since 1972 and an Associate in Risk Management since 1994. Mr. Rue also serves as a director for each of the following organizations: Selective Insurance Group, Inc. (a Nasdaq Global Select Market listed company), Robert Wood Johnson University Hospital Corporation and Robert Wood Johnson University Hospital at Hamilton (where he sits on the compensation committee). In addition, Mr. Rue is a trustee of Rider University, a nonprofit private university. Mr. Rue is also a Certified Insurance Counselor.

Mr. Rue is qualified to serve on our Board of Directors and brings valuable insight to our Board of Directors as a result of his broad range of business skills and his insurance and financial literacy and expertise. Mr. Rue honed these skills and expertise during his long and successful business career, in which he served as president of an insurance companyagency and president of a financial services provider, as well as his service on non-profit boards of directors.

No director of the Company, other than Messrs. Crow Reed and Rue, is also currently a director of any other company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act, of 1934, as amended (the “Exchange Act”), or any company registered as an investment company under the Investment Company Act of 1940.

Each of the above directors of the Company also serves as a director of the Bank.

EXECUTIVE OFFICERSOFFICER WHO AREIS NOT DIRECTORSA DIRECTOR

| Name and Position with the Company | Age | Principal Occupation |

Stephen J. Gilhooly, Senior Vice President, Chief Financial Officer and Treasurer | Senior Vice President and Chief Financial Officer, 1st Constitution Bank/Cranbury, New Jersey | |

Set forth below areis the namesname of, and certain biographical information regarding, an executive officersofficer of the Company who dodoes not serve as a director of the Company. Our other executive officer, Mr. Mangano, serves as the President and Chief Executive Officer and as a director of the Company.

Stephen J. Gilhooly is has been the Senior Vice President and Chief Financial Officer of the Company and the Bank and the Treasurer of the Company.Company since April 1, 2014. Prior to April 1, 2014, Mr. Gilhooly served as the Bank’s Senior Vice President and Chief Financial Officer. Prior to joining the Bank, Mr. Gilhooly most recently served as Senior Vice President and Treasurer of Florida Community

Bank, Weston, Florida, from May 2011 to May 2013. Prior to joining Florida Community Bank, Mr. Gilhooly served as Executive Vice President and Treasurer of the banking subsidiaries of Capital Bank Financial Corporation (formerly North American Financial Holdings) (“CBF”) since September 2010. Prior to its acquisition by CBF, Mr. Gilhooly was Executive Vice President, Treasurer and Chief Financial Officer of TIB Financial Corp. (“TIB”), Naples, Florida, from 2006 to 2010. Prior to joining TIB, Mr. Gilhooly worked for 15 years with Advest, Inc. in New York as Director in its Financial Institutions Group. Mr. Gilhooly earned a B.S. degree in Economics and a M.S. degree in Accounting from the Wharton School of the University of Pennsylvania. He is a Certified Public Accountant and a Chartered Global Management Accountant.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR NOMINEES.

ITEM 2 – ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are asking our shareholders to cast an advisory vote to approve the compensation of our named executive officers as disclosed in our proxy statement under “Executive Compensation” and “Termination of Employment and Change in Control” in the tabular and accompanying narrative disclosure regarding named executive officer compensation.

As required by Section 14A(a)(1) of the Securities Exchange Act, of 1934, as amended (the “Exchange Act”), our shareholders are entitled to vote at the 2017 Annual Meeting to approve the compensation of the Company’s named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K at least once every three years. In(“say on pay vote”). The shareholder vote on executive compensation is an advisory vote only, and is not binding on the Company, the Board of Directors or the Compensation Committee. At our 2013 annual meeting of shareholders held on May 23, 2013, an advisory vote was held on the frequency of the advisory votesay on executive compensation.pay vote. In such advisory vote, the Company’s shareholders voted for the holding ofto hold an advisory vote on the compensation of the Company’s named executive officers once every year (1 year).year.

Our executive compensation arrangements are designed to enhance shareholder value on an annual and long-term basis. Through the use of base pay as well as annual and long-term incentives, we seek to compensate our named executive officers for their contributions to our short-term and long-term profitability and success.success and their efforts to increase shareholder value. Please read “Executive Compensation” beginning on page 2529 and “Termination of Employment and Change in Control Arrangements” beginning on page 3337 of this proxy statement for additional details about our executive compensation arrangements, including information about the fiscal year 20132016 compensation of our named executive officers. We believe that the compensation of our named executive officers for 2016 was consistent with our compensation philosophy and our performance. We are asking our shareholders to indicate their support for our named executive officers’ compensation arrangements as described in this proxy statement. The vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers described in this proxy statement.

For the reasons discussed above, the Board recommends that shareholders vote in favor of the following resolution:

“RESOLVED, that the compensation paid toof the Company'sCompany’s named executive officers, as disclosed in the Company’s Proxy Statement dated April 15, 2014,for the 2017 Annual Meeting of Shareholders, pursuant to Item 402 of

Regulation S-K, including the compensation tables and narrative discussion, is hereby APPROVED.APPROVED on an advisory basis.”

The affirmative vote of a majority of votes cast is required to approve the compensation of our named executive officers. Because your vote is advisory, however, it will not be binding upon or overrule any decisions of the Board or Compensation Committee, nor will it create any additional fiduciary duty on the part of the Board.Board or Compensation Committee. This advisory vote also does not seek to have the Board or Compensation Committee take any specific action. However, the Board and the Compensation Committee value the view expressed by our shareholders in their vote on this proposal and will take into account the outcome of the vote when considering executive compensation matters in the future. In considering the outcome of this advisory vote, the Board will review and consider all shares voted in favor of the proposal and not in favor of the proposal. BrokerAbstentions and broker non-votes will have no impact on the outcome of this advisory vote.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT PURSUANT TO ITEM 402 OF REGULATION

S-K.

S-K.

ITEM 3 -– RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected BDO USA LLP (“BDO”) as the Company’s independent auditorsregistered public accounting firm for the 20142017 fiscal year. BDO has served as the Company’s independent registered public accounting firm since June 28, 2013. ForThe Company’s shareholders ratified the balance of 2013 (i.e., January 1, 2013 to June 28, 2013), ParenteBeard LLC (“ParenteBeard”) served as the Company’s independent registered public accounting firm.

May 26, 2016.

Ratification of the Selection of BDO by Shareholders

In addition to selecting BDO as the Company’s independent registered public accounting firm for the Company’s 20142017 fiscal year, the Audit Committee has directed that management submit the selection of the Company’s independent registered public accounting firm for ratification by the Company’s shareholders at the 2017 Annual Meeting.

One or more representatives of BDO are expected to be present at the Annual Meeting. The representatives will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

Shareholder ratification of the selection of BDO as the Company’s independent registered public accounting firm is not required by the Company’s by-laws or otherwise. However, the Board is submitting the selection of BDO to shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm.BDO. Unless contrary instructions are given, the shares of common stock represented by the proxies

being solicited will be voted “FOR” the ratification of the selection of BDO as the Company’s independent registered public accounting firm for the Company’s 20142017 fiscal year.

Principal Accounting Fees and Services

The Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) and the SEC auditor independence rules require all public accounting firms that audit issuers to obtain pre-approval from their respective audit committees in order to provide professional services without impairing independence.

The fees billed by BDO, the Company’s independent registered public accounting firmsfirm, relating to the 20132016 and 20122015 fiscal years were as follows:

| Type of Service | 2012 (1) | |||

Audit Fees (2) | $ | 163,400 | ||

Audit-Related Fees (3) | 19,100 | |||

Tax Fees (4) | 33,500 | |||

All Other Fees (5) | 30,600 | |||

| Total | $ | 246,600 | ||

| Type of Service | 2013 (6) | 2016 | 2015 | ||||

Audit Fees (7) | $ | 145,855 | |||||

Audit-Related Fees (8) | 41,320 | ||||||

Tax Fees (9) | 22,235 | ||||||

Audit Fees (1) | $ | 309,057 | 210,619 | ||||

Audit-Related Fees (2) | 12,000 | 45,024 | |||||

Tax Fees (3) | 21,929 | 25,146 | |||||

| All Other Fees | - | - | |||||

| Total | $ | 209,410 | $ | 342,986 | 280,789 | ||

| Includes fees for professional services rendered for the audit of the Company’s annual consolidated financial statements and review of consolidated financial statements included in Forms 10-Q, including out-of-pocket expenses. |

| (2) |

| (3) | Includes fees for services rendered for tax compliance. |

In accordance with the Sarbanes-Oxley Act, of 2002, the Audit Committee established policies and procedures under which all audit and non-audit services performed by the Company’s principal accountants must be approved in advance by the Audit Committee. As provided in the Sarbanes-Oxley Act, all audit and non-audit services must be pre-approved by the Audit Committee in accordance with these policies and procedures.

All services described above were approved in accordance with the Audit Committee’s Pre-Approval policy described directly below.

Audit Committee Pre-Approval Procedures

The Audit Committee has adopted a formal policy concerning the pre-approval of audit and non-audit services to be provided by the Company’s independent registered public accounting firm. The policy requires that all services to be performed by the Company’s independent registered public accounting firm, including audit services, audit-related services and permitted non-audit services, be pre-approved by the Audit Committee. The policy permits the Audit Committee to delegate pre-approval authority to one or more members, provided that any pre-approval decisions are reported to the Audit Committee at or prior to its next meeting. Specific services being provided by the independent registered public accounting firm are regularly reviewed in accordance with the pre-approval policy. At subsequent Audit Committee meetings, the Audit Committee receives updates on services being provided by the

independent registered public accounting firm, and management may present additional services for approval. Each new engagement of the Company’s independent registered public accounting firm has been approved in advance by the Audit Committee.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF BDO USA LLPAS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY’S 20142017 FISCAL YEAR.

CORPORATE GOVERNANCE

General

The Company is committed to establishing sound principles of corporate governance which promote honest, responsible and ethical business practices. The Company’s corporate governance practices are actively reviewed and evaluated by the Board of Directors and, if requested by the Board of Directors, the Nominating and Corporate Governance Committee of the Board of Directors. This review includes comparing the Board’s current governance policies and practices with those suggested by authorities active in corporate governance as well as the practices of other public companies. Based upon this evaluation, the Board has adopted those policies and practices that it believes are the most appropriate corporate governance policies and practices for the Company.

Board Leadership Structure and Role in Risk Oversight

Mr. Crow serves as the Chairman of the Board of the Company and of the Bank, and Mr. Mangano isserves as the President and Chief Executive Officer of the Company and of the Bank. We have employed the same basic leadership structure since prior to the time that we became an SEC reporting company in 2001. We separate the roles of Chairman of the Board and Chief Executive Officer in recognition of the differences between the two roles.roles, as we have done since prior to the time that we became an SEC reporting company in 2001. The Chief Executive Officer is responsible for implementing the strategic goals of the Company and for the day to day leadership, operations and performance of the Company, while the Chairman of the Board provides strategic guidance to the Chief Executive Officer, presides over meetings of the full Board and, if the Chairman is independent, presides over executive sessions of the independent directors and chairs meetings of shareholders.

directors.

Our Audit Committee is primarily responsible for overseeing the Company’s risk management processes, and undertakes in its charter to discuss with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. The Audit Committee meets periodically with management to discuss policies with respect to risk assessment and risk management and to review the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures. Each of our other Board committees also considers the risk within its area of responsibilities. For example, our Compensation Committee considers the risks that may be implicated by our executive compensation programs.

While our Audit Committee oversees the Company’s risk management processes with input from our Board, management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing our Company and that our Board leadership structure supports this approach.

Committee Memberships

Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Charles S. Crow, III | X | X | X |

| X | X* | X* | |

| Edwin J. Pisani | X* | | |

| Roy D. Tartaglia | X | ||

| J. Lynne Cannon | X | ||

| James G. Aaron | X | X | |

| | |||

| | X | ||

| X = Committee member; * = Chairman | |||

Director and Nominee Independence

The Board of Directors has affirmatively determined that a majority of the current directors, and of the directors that served in 2016, and all of the respective current members and 2016 members of the Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee, are “independent” within the meaning of the Nasdaq independence standards,standards. The Board has further determined that the members of the Audit Committee are also “independent” for purposes of Section 10A(m)(3) of the Exchange Act and that each member of the Compensation Committee is an “outside director” within the meaning of Regulation 1.162-27 under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and is a “non-employee director” within the meaning of Rule 16b-3(b)(3) promulgated under the Exchange Act (“Exchange Act Rule 16b-3”).

The Board has affirmatively determined that each of Messrs. Crow, Reed, Rue, WalshPisani, Tartaglia, Cannon, Aaron, Cruz, Penta and CostasBarrett has no material relationship with the Company affecting his or her independence as a director and that each is “independent” within the meaning of the independence standards established by Nasdaq. In making each of these independence determinations, the Board considered and broadly assessed, from the standpoint of materiality and independence, all of the information provided by each director and nominee in response to detailed inquiries concerning his or her independence and any direct or indirect business, family, employment, transactional or other relationship or affiliation of such director with the Company and considered the deposit and other banking relationships with each director. In making the independence determinations, the Board also considered the following relationships: (i) with respect to Mr. Rue, the Board considered the fact that CharlesChas. E. Rue &

Son, Inc., which is owned and controlled by Mr. Rue, acts as the Company’s insurance broker and that Mr. Rue owns 25% of a real estate partnership which hasthat had a loan from the Bank during 2016 that is secured by a mortgagewas fully paid in favor of the Bank on property owned by the partnership;2016; (ii) with respect to Mr. Crow, the Board considered the fact that certain entities owned or controlled by Mr. Crow are customers of, and conduct banking transactions with, the Bank in the ordinary course of business on customary terms.terms; (iii) with respect to Mr. Aaron, the Board considered the fact that Ansell, Grimm & Aaron, P.C., a law firm where Mr. Aaron is a partner, provided legal services to the Bank, that Mr. Aaron and his spouse have a home equity line of credit with the Bank with no balance outstanding as of December 31, 2016, and that Mr. Aaron has an ownership interest in an entity that has a line of credit with the bank with no balance outstanding as of December 31, 2016; (iv) with respect to Mr. Cruz, the Board considered that Mr. Cruz and his spouse have a residential mortgage with the Bank, that an entity in which Mr. Cruz’s spouse has an ownership interest leases a branch in Perth Amboy, NJ to the Bank, and that certain entities owned or controlled by Mr. Cruz are customers of, and conduct banking transactions with, the Bank in the ordinary course of business on customary terms; (v) with respect to Mr. Tartaglia, the Board considered that Mr. Tartaglia and his spouse have a home equity line of credit with the Bank with no balance outstanding as of December 31, 2016 and that certain entities owned or controlled by Mr. Tartaglia are customers of, and conduct banking transactions with, the Bank in the ordinary course of business on customary terms; and (vi) with respect to Mr. Penta, the Board considered that Mr. Penta has an ownership interest in an entity that has a construction line of credit with the Bank, which upon completion of such construction, will become a permanent amortizing commercial mortgage loan and that Mr. Penta maintains a deposit account with the Bank. These transactions were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons, and did not involve more than the normal risk of collectability or present other unfavorable features.

Audit Committee

The Audit Committee is currently comprised of Messrs. David C. ReedEdwin J. Pisani (Chairman), John P. Costas, Charles S. Crow, III, William M. Rue and Roy D. Tartaglia. Messrs. Crow and Rue were members of the Audit Committee for all of 2016, and Messrs. Pisani and Tartaglia became members of the Audit Committee effective June 20, 2016 and have served continuously on such committee through the date of this proxy statement. Mr. Pisani was appointed Chairman of the Audit Committee on June 20, 2016 and has served continuously in such capacity through the date of this proxy statement. From January 1, 2016 until his resignation as a director on June 17, 2016, Mr. Frank E. Walsh, III. III served as Chairman of the Audit Committee. Mr. John P. Costas was also a member of the Audit Committee from January 1, 2016 until his resignation as a director on June 17, 2016.

The Audit Committee serves as a communication point among non-Audit Committee directors, internal auditors, employees of the Company’s independent accountantsregistered public accounting firm and Company management as their respective duties relatewith respect to, among other things, financial accounting, financial reporting and internal controls. The Audit Committee assists the Board of Directors in fulfilling its responsibilities with respect to accounting policies, internal controls, financial and operating controls, standards of corporate conduct and performance, financial reporting practices and sufficiency of auditing.

The principal functions of the Audit Committee include:

assisting the Board in the oversight of the integrity of the Company’s financial statements and its financial reporting processes and systems of internal controls;

overseeing the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements; and

| appointing and retaining, compensating and overseeing the work of any independent registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company. |

The Board has determined that all Audit Committee members are able to read and understand financial statements and at least one member has accounting or related financial management expertise in accordance with the applicable Nasdaq rules. The Board has also determined that David C. ReedEdwin J. Pisani qualifies as an “audit committee financial expert” and he serves as the Company’s “audit committee financial expert.” No member of the Audit Committee received any compensation from the Company during fiscal year 20132016 other than compensation for services as a director.

director or member of a Committee of the Board.

The Audit Committee charter is not available to security holders on the Company’s website. The Audit Committee charter, which was most recently amended in on December 15, 2016, is included as Appendix A to this proxy statement.

Report of the Audit Committee

The Audit Committee of the Company is currently comprised of fivefour independent directors appointed by the Board of Directors, each of whom is independent for purposes of Audit Committee membership under applicable Nasdaq and SEC rules. Frank E. Walsh, III and John P. Costas were each determined by the Board to be independent for purposes of audit committee membership under applicable Nasdaq and SEC rules.rules during their service as members of the Audit Committee. The Audit Committee operates under the Audit Committee charter, which was adopted in March 2004.2004 and most recently amended on December 15, 2016. The Audit Committee charter provides that the Audit Committee shall have the sole authority to appoint or replace the Company’s independent registered public accounting firm.

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting principles, internal controls, and procedures designed to ensure compliance with accounting standards and applicable laws and regulations. The Company’s independent registered public accounting firm performs an annual independent audit of the financial statements and expresses an opinion on the conformity of those financial statements in accordance with generally accepted accounting principles in the United Statesstandards of America.the Public Company Accounting Oversight Board (United States). The Audit Committee’s responsibility is to monitor and oversee these processes and report its findings to the full Board. The Audit Committee assists the Board in monitoring:

the integrity of the financial statements of the Company;

the performance of the Company’s internal audit function and independent registered public accounting firm; and

The Audit Committee reviews the results of the Company’s audit, of its interim quarterly reviews, the overall quality of the Company’s accounting policies and other required communications, including those described in Statement onby Auditing StandardsStandard No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), “Communications with Audit Committees,”1301, as adopted by the Public Company Accounting Oversight

Board (“PCAOB”) in Rule 3200T.. The Company’s independent registered public accounting firm assists management, as necessary, in updating the Audit Committee concerning new accounting developments and their potential impact on the Company’s financial reporting. The Audit Committee also meets five (5)six (6) times a year with the Company’s independent registered public accounting firm without management present.

The Audit Committee reviews and discusses with management the Company’s annual audited financial statements and quarterly financial statements, including the Company’s disclosures under Management’s Discussion and Analysis of Financial Condition and Results of Operations. The Audit Committee also meets with Company management, without the Company’s independent registered public accounting firm present, to discuss management’s evaluation of the performance of the independent registered public accounting firm.

firm.

With respect to fiscal year 2013,2016, the Audit Committee:

met with management and BDO and reviewed and discussed the Company’s audited financial statements and discussed significant accounting issues;

discussed with BDO the scope of its services, including its audit plan;

discussed with BDO the matters required to be discussed by PCAOB Auditing Standard No. 16 (communications with the Audit Committee);

reviewed and approved all audit and non-audit services provided by BDO during fiscal year 2016.

Based on the foregoing review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K10‑K for the fiscal year ended December 31, 20132016 for filing with the SEC.

Members of the Audit Committee

ROY D. TARTAGLIA

CHARLES S. CROW, III

Compensation Committee

The Compensation Committee is currently comprised of Messrs. John P. CostasWilliam M. Rue (Chairman), Charles S. Crow, III, David C. Reed, William M. Rue,J. Lynne Cannon and Frank E. Walsh, III,James G. Aaron, each of whom has been determined by the Board to be “independent” within the meaning of the Nasdaq independence standards, and each of whom is an “outside director” within the meaning of Code Section 162(m) and is a “non-employee director” within the meaning of Exchange Act Rule 16b-3. Messrs. Rue and Crow were members of the Compensation Committee for all of 2016, and Messrs. Cannon and Aaron became members of the Compensation Committee effective June 20, 2016 and have served continuously on such committee through the date of this proxy statement. Mr. Rue also served as Chairman of the Compensation Committee for all of 2016 and continues to serve in such capacity. In addition, Messrs. Frank E. Walsh, III and John P. Costas served on the Compensation Committee from January 1, 2016 until they resigned from the Board on June 17, 2016. During their service on the Compensation Committee, Messrs. Frank E. Walsh III and John P. Costas had each been determined by the Board to be “independent” within the meaning of the Nasdaq independence standards, and each of them was an “outside director” within the meaning of Code Section 162(m) and a “non-employee director” within the meaning of Exchange Act Rule 16b-3.

The Compensation Committee reviews and approves the compensation arrangements for the Company’s executives and outside directors. The Compensation Committee administers the Company’s equity incentive plans and makes awards pursuant to those plans.

No Compensation Committee member participates in any of the Company’s employee compensation programs. The Board has determined that none of the current Compensation Committee members has any material business relationships with the Company.

The Compensation Committee charter is not available to security holders on the Company’s website. The Compensation Committee charter, which was most recently amended in May 2013,on December 15, 2016, is included as Appendix B to this proxy statement.

Role of the Compensation Committee

The Compensation Committee is appointed by the Board of Directors. Subject to the final review and approval by the Board, the Compensation Committee evaluates, determines and approves the compensation of the Company’s Chief Executive Officer, its principal accounting officer and outside directors. The Compensation Committee administers the Company’s equity plans. The Compensation Committee also has overall responsibility for monitoring, on an ongoing basis, the executive compensation policies, plans and programs of the Company. The Compensation Committee may delegate its authority relating to non-employee director compensation to a subcommittee consisting of one or more members when appropriate.

Compensation Committee Process and Role of Management

The Compensation Committee generally holds two regularly scheduled in-person meetings a year and additional meetings as appropriate, either in person or by telephone. Generally, the Compensation Committee chairChairman works with management in establishing the agenda for Compensation Committee meetings. Management also prepares and submits information during the course of the year for the consideration of the Compensation Committee, such as management’s proposed recommendations to the Compensation Committee for performance measures and proposed financial targets, management’s proposed recommendations to the Compensation Committee for salary increases, management’s

performance evaluations of executive officers, and other data and information, if requested by the Compensation Committee.

Although many of the compensation decisions are made during the Compensation Committee’s annual review process, the compensation planning process spans throughout the year. Subject to the final review and approval by the Board, the Compensation Committee reviews and approves the Company’s goals and objectives relevant to the Chief Executive Officer’s compensation, evaluates the Chief Executive Officer’s performance in light of those goals and objectives at least once per year and determines the Chief Executive Officer’s compensation level based on this evaluation. The Chief Executive Officer is not present during voting or deliberations with respect to his compensation. On an annual basis, the Compensation Committee also reviews and approves base salary, annual incentive compensation and long-term equity-based compensation of the other executive officer of the Company.

Risk Assessment of Compensation Programs

The Compensation Committee discusses, evaluates and reviews with the Company’s senior risk officer all of our employee compensation programs in light of the risks posed to us by such programs and how to limit such risks and to assess whether any aspect of these programs would encourage any employees to manipulate reported earnings to enhance their compensation and assess whether any aspect of these programs would encourage the Company’s senior executive officers to take any unnecessary or excessive risks that could threaten the value of the Company. Included in the analysis are such factors as (i) the appropriate levels of “fixed” and “variable” or “at risk” compensation, (ii) the appropriate levels of long-term incentive compensation between service-based and performance-based compensation and (iii) the risk and performance criteria, if any, attached to the awards under employee compensation plans. Based on this assessment, the Compensation Committee determined that the Company’s executive compensation programs are not reasonably likely to encourage the Company’s senior executive officers to take unnecessary or excessive risks that could have a material adverse effect on the Company.

Compensation Committee Advisors

The Compensation Committee charter grants the Compensation Committee full authority to engage compensation consultants and other advisors to assist it in the performance of its responsibilities. Prior to retaining, or seeking advice from, a compensation consultant or other advisor, the Compensation Committee must consider the independence of such compensation consultant or other advisor, taking into consideration the factors set forth in the Compensation Committee charter. A compensation consultant retained by the Compensation Committee reports directly to the Compensation Committee.

The Compensation Committee relies on management and outside advisers for staff work and technical guidance in conducting its affairs. It retains full authority to engage independent third party advisers. In 2013,2016, the Compensation Committee didengaged Pearl Meyer & Partners, LLC (the “Compensation Consultant”) as compensation consultant to the Compensation Committee to conduct independent studies and provide recommendations with respect to executive and employee compensation. The Compensation Consultant’s primary role with the Company is as independent adviser to the Compensation Committee on matters relating to executive and employee compensation. The Compensation Committee assessed the independence of the Compensation Consultant and determined that its work for the Compensation Committee has not engageraised any conflict of interest.

In 2016, the Compensation Consultant provided services to the Compensation Committee, including (i) a refreshed compensation consultants.review for up to 10 executive officers of the Company and/or the

Bank, including the Company’s named executive officers, (ii) an assessment of the Bank’s compensation components compared to survey and peer group data and (iii) recommendations for total compensation opportunity guidelines (i.e., base salary and short and long-term incentive targets). The Compensation Consultant does not provide any services to the Company or any of its subsidiaries other than the services provided to the Compensation Committee.

Director Compensation Process

A discussion of the Company’s determination of director compensation is included in the “Director Compensation” section of this proxy statement.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is currently comprised of Messrs. William M. Rue (Chairman), Charles S. Crow, III, James G. Aaron and Antonio L. Cruz. Messrs. Rue and Crow were members of the Nominating and Corporate Governance Committee for all of 2016, and Messrs. Aaron and Cruz became members of the Nominating and Corporate Governance Committee effective June 20, 2016and have served continuously on such committee through the date of this proxy statement. Mr. Rue also served as Chairman of the Compensation Committee for all of 2016 and continues to serve in such capacity. In addition, Messrs. Frank E. Walsh, III and John P. Costas Charles S. Crow, IIIserved on the Nominating and David C. Reed.Corporate Governance Committee from January 1, 2016 until they resigned from the Board on June 17, 2016. The Nominating and Corporate Governance Committee is responsible for recommending, for consideration by the Board, candidates to serve as directors of the Company as well as the re-election of current directors. The committee also reviews recommendations from shareholders regarding director candidates and corporate governance and director candidates.governance. The procedure for submitting recommendations of director candidates is set forth below under the caption “Selection of Director Candidates.”

In accordance with the marketplace rules of the Nasdaq Global Market, the Nominating and Corporate Governance Committee is currently, and was during 2013,2016, composed entirely of independent and non-management members of the Board of Directors.

The Nominating and Corporate Governance Committee charter is not available to security holders on the Company’s website. The Nominating and Corporate Governance Committee charter, which was most recently amended on December 15, 2016, is included as Appendix C to this proxy statement.

Selection of Director Candidates

The Nominating and Corporate Governance Committee has established a policy regarding the consideration of director candidates, including those recommended by shareholders. The Nominating and Corporate Governance Committee, together with the President and other Board members, will, from time to time as appropriate, identify the need for new Board members. Particular proposed director candidates who satisfy the criteria set forth below and otherwise qualify for membership on the Board will be identified by the Nominating and Corporate Governance Committee. In identifying candidates, the Nominating and Corporate Governance Committee will seek input and participation from the President, other Board members, and other appropriate sources, to ensure that all points of view can be considered and the best possible candidates can be identified. The Nominating and Corporate Governance Committee may also, as appropriate, engage a search firm to assist it in identifying potential candidates. Members of the Nominating and Corporate Governance Committee, the President and other Board members, as appropriate, may personally interview selected director candidates and provide input to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will determine which candidate(s) are to be recommended to the Board for approval.

Diversity is one of the factors that the Nominating and Corporate Governance Committee considers in identifying nominees for director. This means that the Nominating and Corporate Governance Committee seeks nominees for recommendation who bring a variety of business backgrounds, experiences and perspectives to the Board. We believe that the backgrounds and qualifications of the directors, considered as a group, should provide a broad diversity of experience, professions, skills, geographic representations, knowledge and abilities that will allow the Board to fulfill its responsibilities. In selecting director nominees for recommendation, the Nominating and Corporate Governance Committee considers all aspects of a potential nominee’s background, including educational background, gender, business and professional experience, and particular skills and other qualities. The goal of the Nominating and Corporate Governance Committee is to identify individuals who will enhance and add valuable perspective to the Board and who will help us capitalize on business opportunities in a challenging and highly competitive market. The Nominating and Corporate Governance Committee has not adopted a formal diversity policy with regard to the selection of director nominees.

Shareholders wishing to submit a director candidate for consideration by the Nominating and Corporate Governance Committee must submit the recommendation to the Nominating and Corporate Governance Committee, c/o President and Chief Executive Officer,Secretary, 1st Constitution Bancorp, P.O. Box 634, 2650 Route 130 North, Cranbury, New Jersey 08512, in writing, not less than 90 days prior to the first anniversary date of the preceding year’s annual meeting. The request must be accompanied by the same information concerning the director candidate and the recommending shareholder as described in Article I, Section 9 of the Company’s by-lawsBy-laws for shareholder nominations for director. The Nominating and Corporate Governance Committee may also request any additional background or other information from any director candidate or the recommending shareholder as it may deem appropriate. Nothing above shall limit a shareholder’s right to propose a nominee for director at an annual meeting in accordance with the procedures set forth in the Company’s by-laws.

By-laws.

All directors play a critical role in guiding the Company’s long-term business strategy and in overseeing the management of the Company. Board candidates are considered based on various criteria which may change over time and as the composition of the Board changes. The following factors, at a minimum, are considered by the Nominating and Corporate Governance Committee as part of its review of all director candidates and in recommending potential director candidates to the Board:

appropriate mix of educational background, professional background and business experience to make a significant contribution to the overall composition of the Board;

if the Committee deems it applicable, whether the candidate would be considered independent under Nasdaq rules and the Board’s additional independence guidelines set forth in the Company’s Corporate Governance Guidelines;

demonstrated character and reputation, both personal and professional, consistent with the image and reputation of the Company;

ability to work productively with the other members of the Board; and

| availability for the substantial duties and responsibilities of a director of the Company. |

Attendance at Board Meetings, Committee Meetings, and Annual Meetings